The smart Trick of Eb5 Investment Immigration That Nobody is Discussing

The smart Trick of Eb5 Investment Immigration That Nobody is Discussing

Blog Article

Excitement About Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration Can Be Fun For AnyoneOur Eb5 Investment Immigration DiariesEb5 Investment Immigration for Dummies5 Simple Techniques For Eb5 Investment ImmigrationRumored Buzz on Eb5 Investment Immigration

While we strive to provide exact and up-to-date material, it must not be thought about lawful recommendations. Migration legislations and guidelines are subject to transform, and specific scenarios can vary widely. For individualized assistance and legal advice concerning your certain immigration situation, we highly recommend talking to a certified immigration lawyer who can provide you with customized support and make sure conformity with present regulations and regulations.

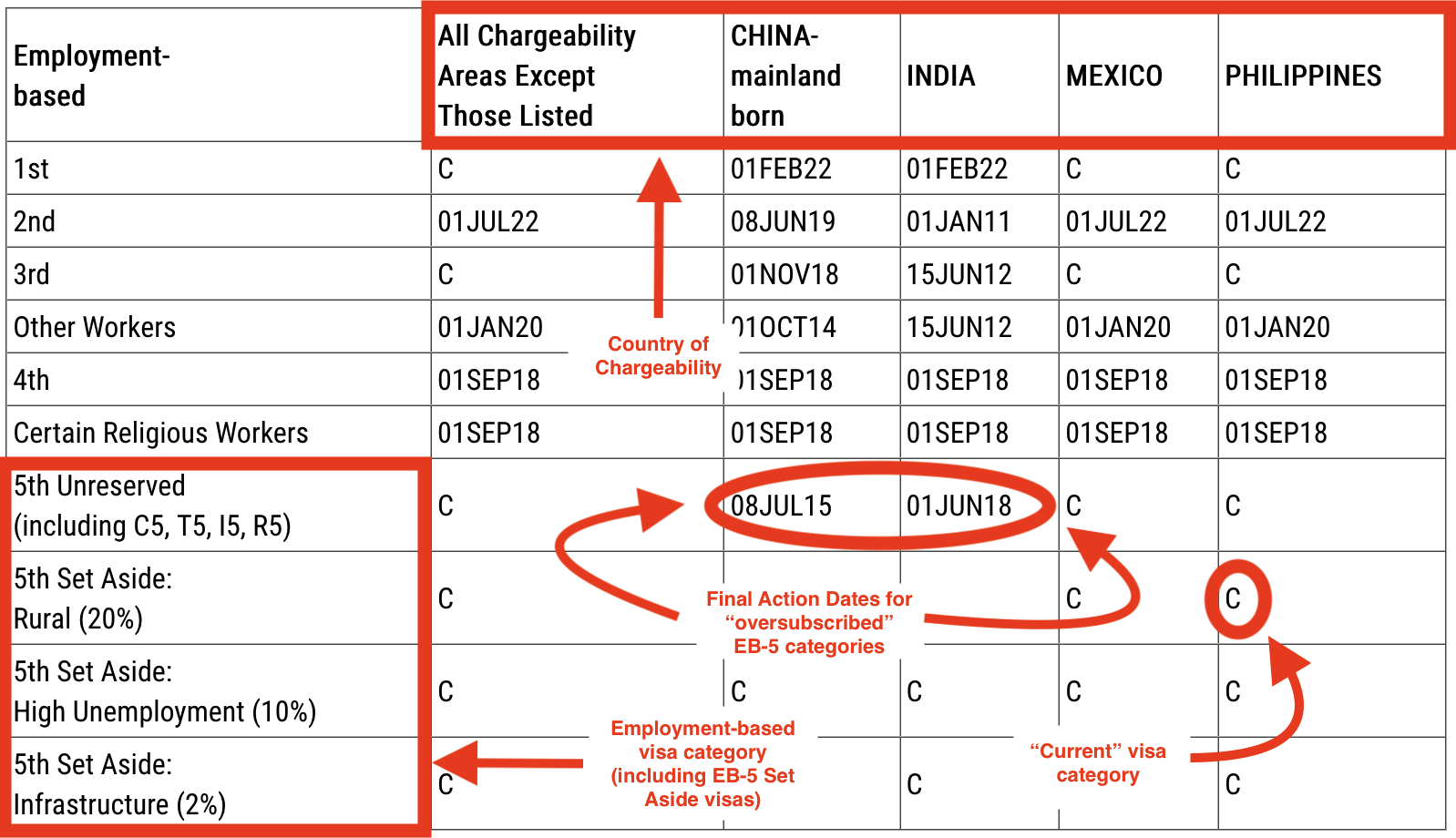

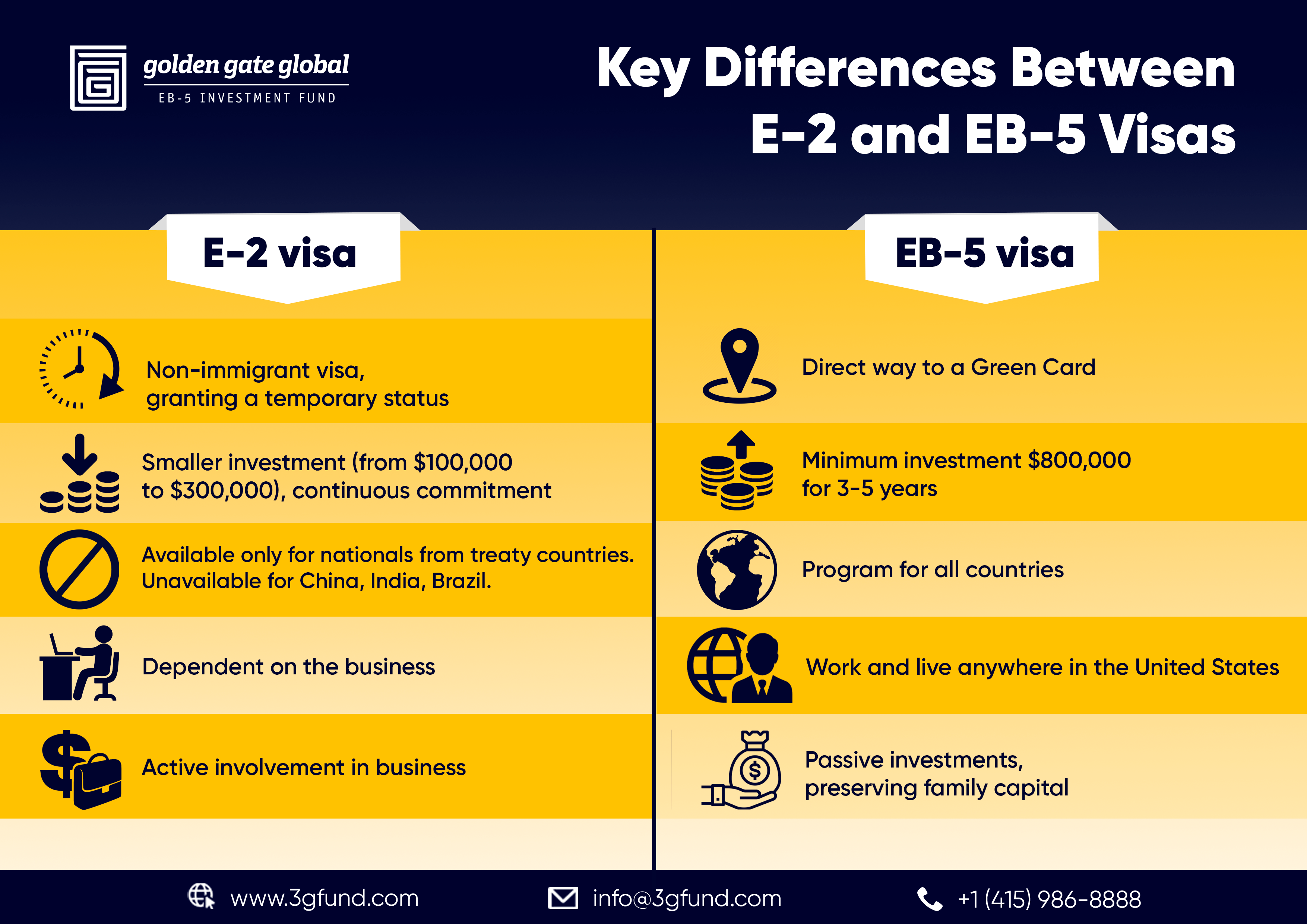

Citizenship, with financial investment. Currently, as of March 15, 2022, the amount of financial investment is $800,000 (in Targeted Employment Areas and Country Locations) and $1,050,000 somewhere else (non-TEA areas). Congress has authorized these amounts for the following 5 years starting March 15, 2022.

To get approved for the EB-5 Visa, Capitalists should develop 10 full-time U.S. tasks within two years from the date of their complete investment. EB5 Investment Immigration. This EB-5 Visa Demand ensures that financial investments add straight to the U.S. job market. This applies whether the tasks are developed directly by the industrial venture or indirectly under sponsorship of a marked EB-5 Regional Facility like EB5 United

Indicators on Eb5 Investment Immigration You Should Know

These work are identified with designs that utilize inputs such as advancement prices (e.g., building and construction and tools expenditures) or yearly profits produced by continuous operations. In contrast, under the standalone, or straight, EB-5 Program, just straight, full time W-2 employee positions within the company may be counted. An essential threat of relying exclusively on direct employees is that team reductions as a result of market problems can result in insufficient full-time positions, potentially causing USCIS rejection of the financier's request if the work creation demand is not fulfilled.

The economic version after that predicts the variety of straight work the new service is most likely to produce based on its anticipated revenues. Indirect jobs determined via financial designs describes work generated in markets that provide the goods or solutions to the business straight associated with the project. These jobs are developed as an outcome of the enhanced demand for items, products, or services that support the company's operations.

The Only Guide for Eb5 Investment Immigration

An employment-based 5th choice group (EB-5) financial investment visa offers an approach of becoming a long-term U.S. homeowner for international nationals wishing to spend capital in the United States. In order to obtain this permit, a foreign financier has to invest $1.8 million (or $900,000 in a Regional Facility within a "Targeted Work Location") and create or protect at the very check out here least 10 permanent jobs for United States employees (excluding the financier and their immediate family members).

This action has been a significant success. Today, 95% of all EB-5 funding is raised and invested by Regional Centers. Since the 2008 economic crisis, accessibility to capital has actually been constricted and metropolitan budget plans continue to encounter considerable shortages. In many areas, EB-5 financial investments have actually loaded the funding space, providing a new, essential source of capital for local financial growth projects that renew communities, develop and support work, framework, and services.

An Unbiased View of Eb5 Investment Immigration

employees. Additionally, the Congressional Budget Workplace (CBO) racked up the program as earnings neutral, with administrative expenses paid for by applicant fees. EB5 Investment Immigration. Greater than 25 countries, including Australia and the UK, use similar programs to draw in international financial investments. The American program is much more strict than several others, requiring substantial danger for investors in regards to both their financial investment and immigration status.

Households and individuals who seek to relocate to the United States on a long-term basis can request the EB-5 Immigrant Investor Program. The USA Citizenship and next Immigration Solutions (U.S.C.I.S.) established out numerous needs to acquire irreversible residency with the EB-5 visa program. The requirements can be summarized as: The financier must meet capital expense quantity requirements; it is usually called for to make either a $800,000 or $1,050,000 capital expense quantity into an U.S.

Talk to a Boston immigration attorney regarding your demands. Here are the general actions to getting an EB-5 investor permit: The very first step is to locate a qualifying investment opportunity. This can be a brand-new company, a local facility task, or an existing company that will be broadened or reorganized.

Once the possibility has been identified, the capitalist should make the investment and send an I-526 petition to the united state Citizenship and Immigration Provider (USCIS). This application needs to include proof of the financial investment, such as financial institution statements, acquisition agreements, and organization strategies. The USCIS will evaluate the I-526 request and either accept it or request added proof.

Not known Details About Eb5 Investment Immigration

The capitalist needs to look for conditional residency by sending an I-485 application. This application has to be submitted within six months of the I-526 approval and have to consist of evidence that the investment was made and that it has developed a minimum of 10 permanent jobs for U.S. workers. The USCIS will certainly examine the I-485 application and either approve it or request extra evidence.

Report this page